Investment Philosophy

Our Investment Philosophy

We think that following a long-term, bottom-up, value-oriented approach to investing based on comprehensive fundamental study and analysis yields higher investment results.

Our tried-and-true methodology is based on two key ideas that have been practiced for a long time:

- Quality

- Value

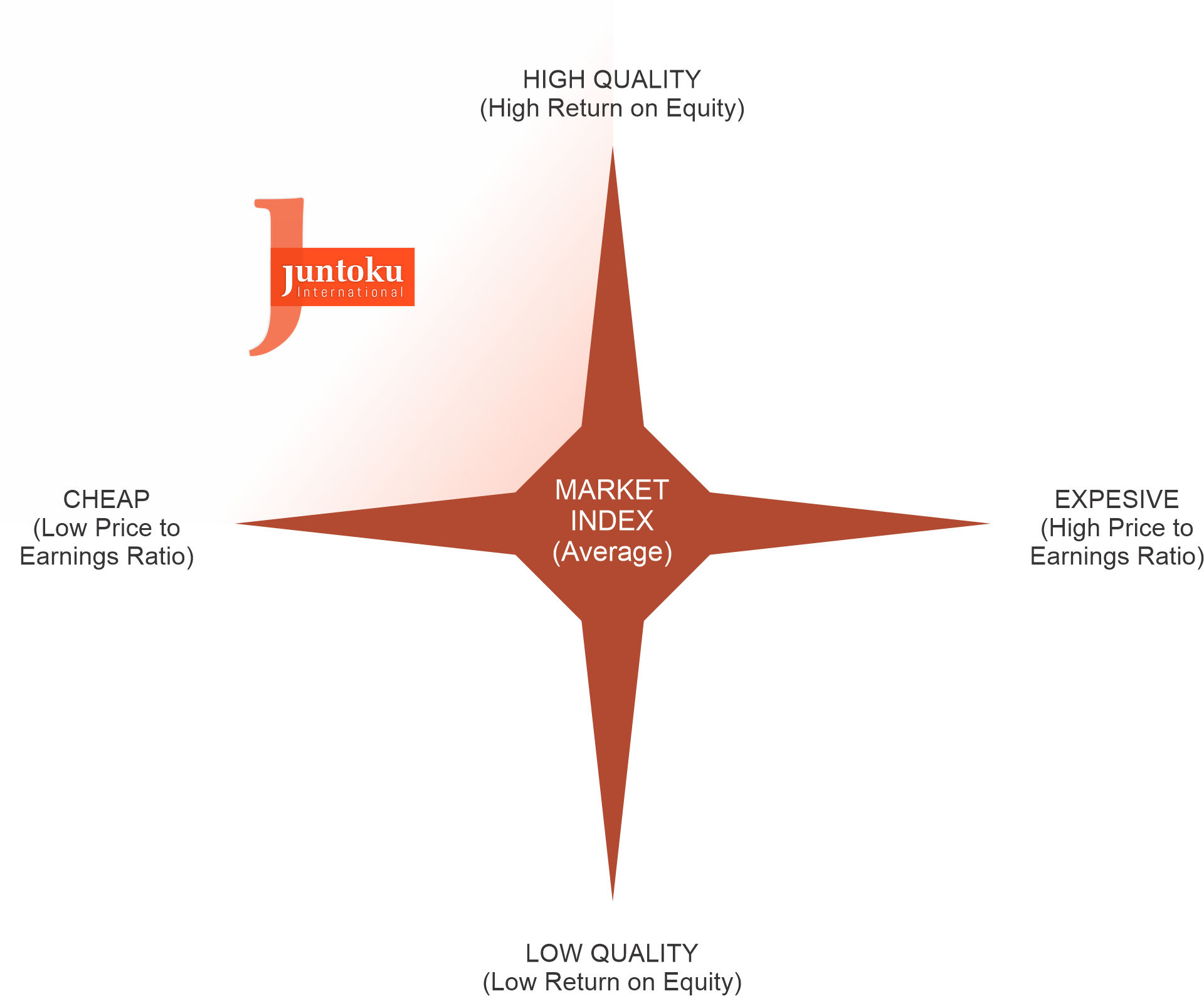

In the case of equities, we aim to invest in high-quality firms with lower valuation than the broader market, seeking to appear in the top left quadrant of the chart below.

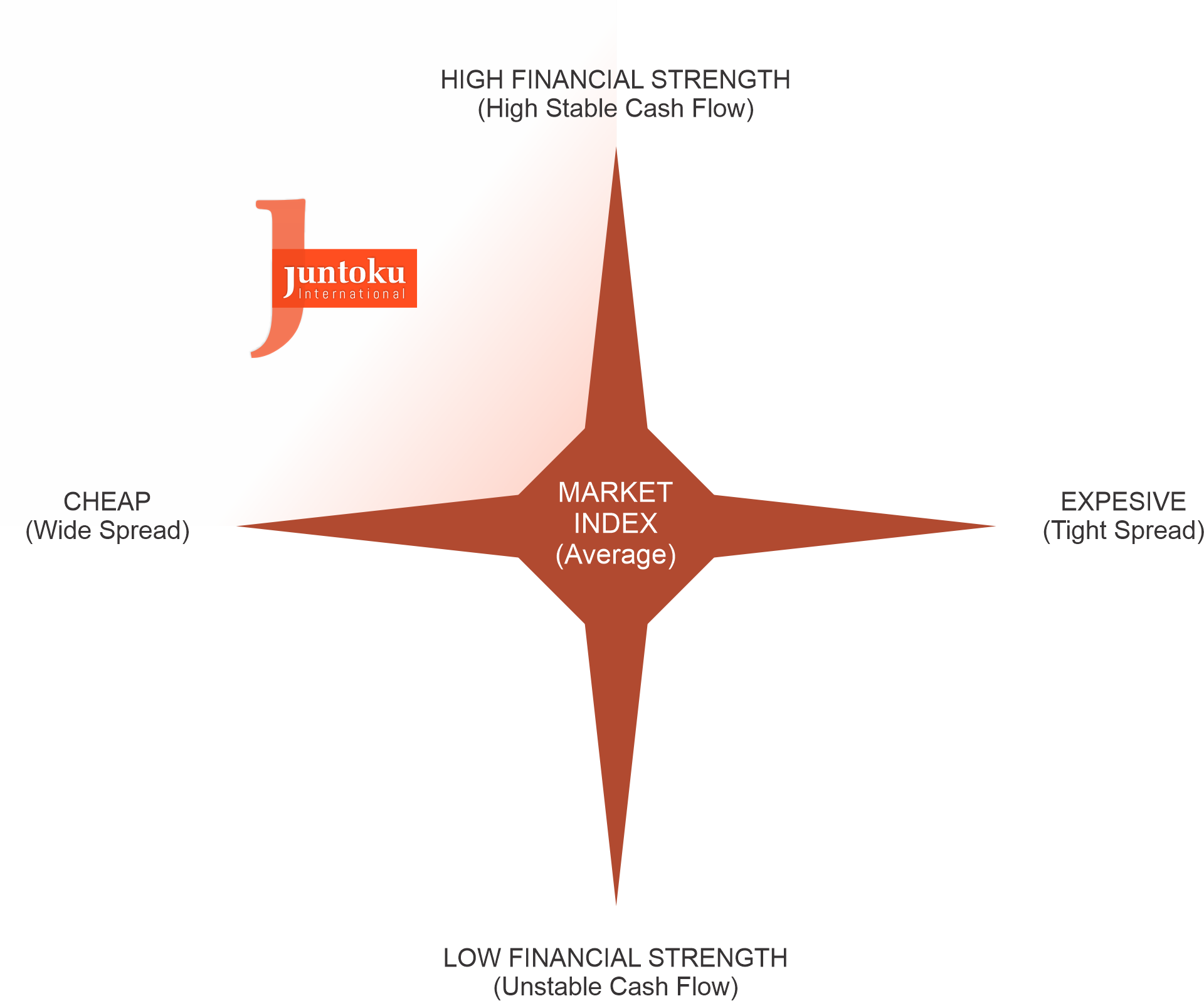

We invest in fixed income instruments that we consider being of excellent quality and have favorable prices. For alternative investments, this positions us in the upper left quadrant of the chart below.

Juntoku International Makes the Difference

A range of factors make up the Juntoku International difference:

- Our firm is focused on investments and profitability;

- We have the ability to manage our clients' assets across a variety of economic cycles in business;

- Our analysts and portfolio managers have a wealth of expertise and go to great lengths to properly comprehend the companies in which we invest;

- We use a methodical approach to investing in quality and value. Long-term investments at reasonable pricing are a priority;

- We seek to outperform the index by being distinctive;

- Our business has a culture of seamless succession from generation to generation.

These characteristics are defining our values and inspire our commitment to achieving our clients' long-term investment goals.

Equity Investment Process

Our equities methodology is centered on managing long-term portfolios. Each equity portfolio is treated as a unique collection of high-quality investments. We are particularly selective since we have a high potential for achieving excellent outcomes.

Characteristics

- Investment team with long-term track record

- Reliable management and strategy

- Conservative balance sheet

Quality

- High-quality or improving operating earnings

- Self-sustaining businesses

Value

- Shorter payback period

Key Measures

- A great deal of experience within operating earnings

- Company's actions correspond with management's insights

- Low debt/equity ratio

- "Per share" profitability

- Higher return on equity (ROE)

- Lower price/book ratio

- Dividend growth

- Cash flow exceeding net income

- Stable share count

- Lower price-to-earnings (P/E)

- Discount to net asset value (NAV)

We are always on the lookout for, and occasionally investing in, firms that have strong management teams and solid business objectives but are experiencing what we view to be temporary challenges.